For instance the famous Wankhede cricket stadium in Mumbai Maharashtra is in a total of 13 acres of land that is equal to 56629064 sq. Use our Mercedes-Benz Financial Calculator to explore our innovative finance and insurance products.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

You need to pay a stamp duty when you buy a property and also when you go in for a rental agreement.

. What is stamp duty. Generally it is easy to calculate stamp duty according to the rates provided by the Indian Stamp Act or the State. Stamp Duty Land Tax SDLT is a tax paid by the buyer of a UK residential property when the purchase price exceeds 125000.

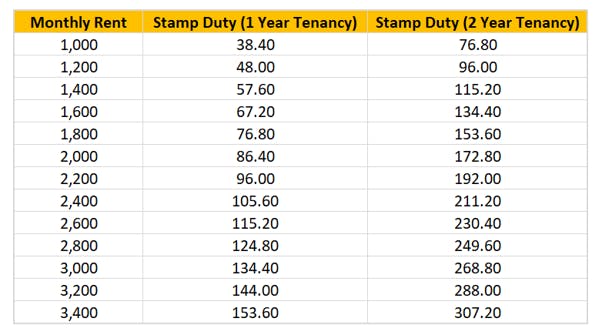

Stamp duty on rental agreements. Do I need to pay stamp duty on non-residential property. Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties.

Office Address Level 10-1 Tower B Menara Prima Jalan PJU 139 Dataran Prima 47301 Petaling Jaya Selangor Malaysia Mon-Fri 9am-6pm T 6 03 7887 2702. Get your estimated instalment for your dream car without any hassle. Calculate the stamp duty you may have to pay on your property using our tool.

Delay in payment of stamp duty can make the individual liable to pay a fine ranging from 2 to 200 of the total payable amount. So if you need to be on a safer side you can make the agreement on a Stamp paper of the appropriate value as prescribed by the government. The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status.

Just as the stamp duty rate varies from state to state so does the timeframe in which people need to pay it. Learn how to calculate stamp duty from a trusted source with PropertyGuru Finance and use our reliable. In contrast pursuant to the Stamp Duty Exemption No.

Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary. The stamp duty is to be made by the purchaser or buyer and not the seller. Welcome to Mercedes-Benz Finance and Insurance Calculator.

The law does provide for a stamp duty exemption for a transfer of property by way of love and affection. When do you have to pay stamp duty. For instance the famous Wankhede cricket stadium in Mumbai Maharashtra is in a total of 13 acres of land that is equal to 56629064 sq.

The stamp duty rate ranges from 2 to 12 of the purchase price depending upon the value of the property bought the purchase date and whether you are a multiple home owner. Stamp duty is the governments charge levied on different property transactions. Stamp duty is payable under Section 3 of the Indian Stamp Act 1899.

Stamp duty is 1 of the total rent plus deposit paid annually or Rs. Buyers will be sent this in an email sometime. 500- whichever is lower.

10 Order 2007 the law provides for stamp duty exemption for a transfer of property between family members by way of love and affection as follows. Transferor Transferee Exemption Rate. Stamp duty in Singapore is a type of tax that all homeowners must be familiar with.

To get the final premium payable for a comprehensive insurance coverage you need to add in 6 GST optional insurance coverage windshield flood audio system and others listed below and a stamp duty fee of RM10. Along with India the US UK Canada Bangladesh Pakistan Nepal Hong Kong Ghana Singapore and Malaysia are the other countries that use square feet for the measurement of the land. When purchasing non-residential property in England or Wales you are still obliged to pay Stamp Duty Land Tax SDLT - a tax levied on property transactions and payable to Inland Revenue - on non-residential assets above the value of 150000 as it currently stands.

Also read all about income tax provisions for TDS on rent. Along with India the US UK Canada Bangladesh Pakistan Nepal Hong Kong Ghana Singapore and Malaysia are the other countries that use square feet for the measurement of the land. The agreement should be printed on a Stamp paper of minimum value of Rs100 or 200-.

Final Premium Payable for Comprehensive Coverage Gross Premium Optional Coverage If any 6 GST Stamp Duty RM1000. ACT payable within 28 days of settlement purchasers must pay stamp duty within 14 days of receiving a Notice of Assessment from Access Canberra.

How Much Does It Cost For Stamp Duty For Tenancy Agreement In Malaysia Ec Realty

What Is A Trust Deed And Why Is It Important

Mot Calculation 2020 Property Paris Star

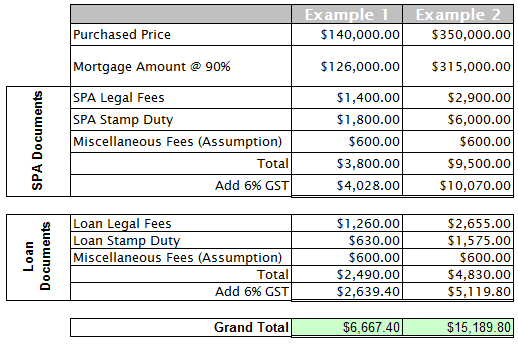

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

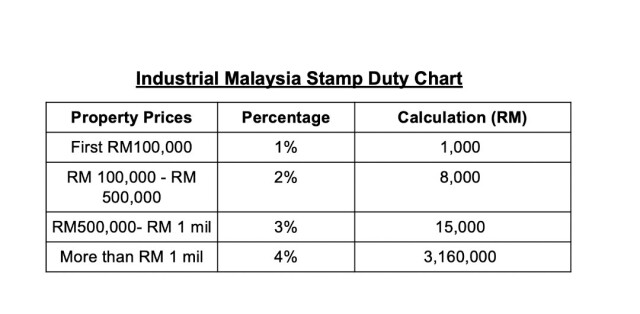

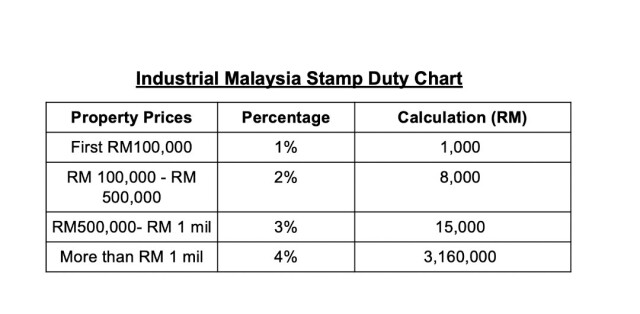

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

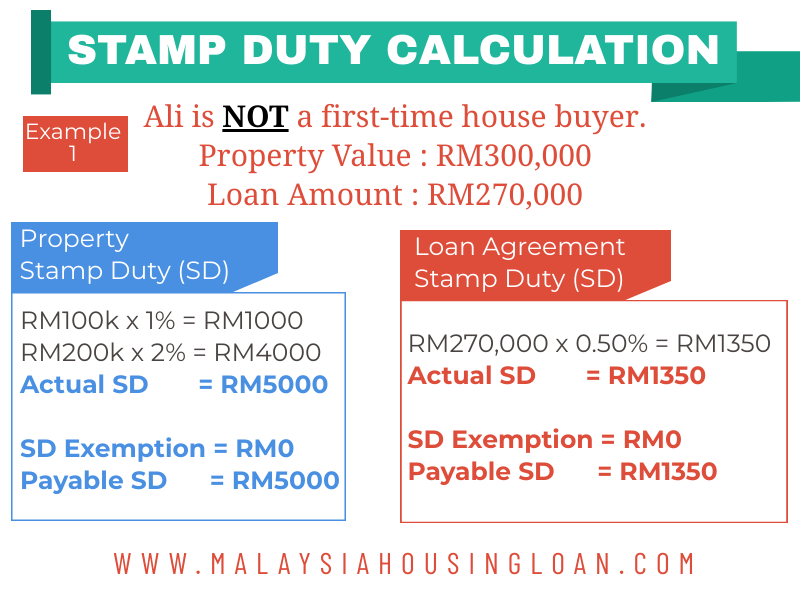

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Sheldon Property Malaysia Property Stamp Duty Calculation Facebook By Sheldon Property

Malaysia 2021 Vs 2022 Stamp Duty On Share Trading Contract Notes Youtube

Stamp Duty Calculator 2020 Online Discount Shop For Electronics Apparel Toys Books Games Computers Shoes Jewelry Watches Baby Products Sports Outdoors Office Products Bed Bath Furniture Tools Hardware Automotive

How To Transfer Property Ownership Between Family Members In Malaysia Propsocial

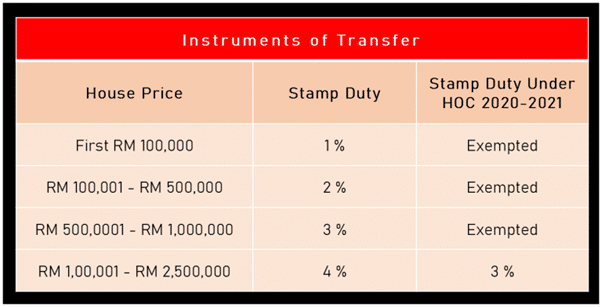

Home Ownership Campaign Hoc 2021 Properly

Ws Genesis E Stamping Services

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Everything You Need To Know Before Signing A Tenancy Agreement Instahome

Malaysia Stock Calculator Apps On Google Play

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia